Designing Social Flows - Chapter 6 on Designing Incentives

[ This is an original / pre-edit draft submission for a book on Designing for Social Flows. It is being curated by Jean Russel and Herman Wagter collecting pieces from thought leaders in the field. I will edit this to link to the book once it is published. ]

Becoming a Culture Hacker

When I learned that building things alone is just not as interesting as collaborative creation, community became my canvas for building new things. In the mid-1990s, this surfaced as a calling to create “community at WORK together.” So I started a company with some friends with only a commitment to build co-creative magic. By ‘only,’ I mean we had no real business experience, no business plan, no revenue model, no product and no clear idea of what value we had to offer. But we had plenty of lofty ideals about how we wanted to build community, relate to each other, and work together.

We were extremely successful at building community, and surprisingly, it turned out we even did fairly well as a business. We found ourselves as an Internet company, growing quickly in the midst of the dot-com-boom. We were a self-organizing company, structured such that people did not have managers (only projects did) and growing like that presented us with a worthy challenge. How do you build an inspiring community of friends, peers and collaborators, yet still ensure the accountability, reliability and results needed for everyone to take home a paycheck with no management or supervisors?

As we evolved, we invented a sophisticated system of performance measures. The company and each team set monthly targets. Each person, with a coach of their choosing, created their individual accountabilities and targets. To be able to acknowledge people’s diverse contributions, we invented creative ways of measuring many things normally considered “intangible.” Paychecks were based on your blend of performance at the individual, team and company levels.

Our company was so successful at building an empowering culture that we had a waiting list of people wanting to work there. We won awards. People wanted to know more so we started hosting a monthly Inventing Business Series which attracted hundreds of people.

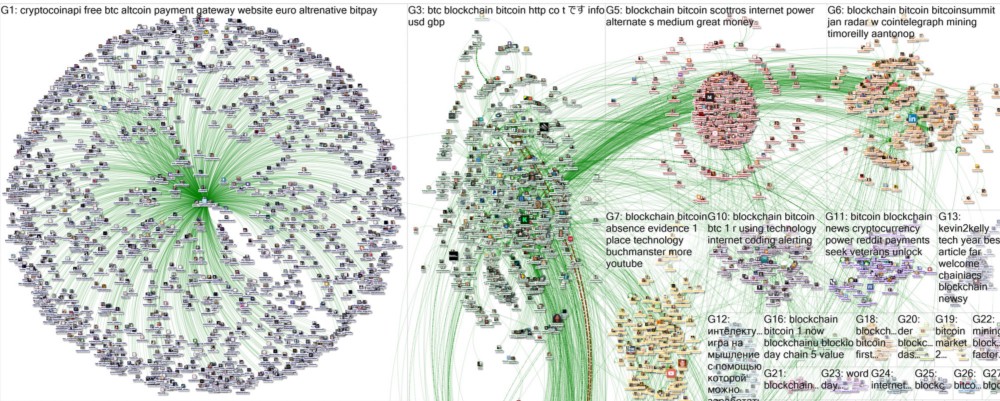

We had invented tools and systems to build an intentional culture, strengthen relationships, establish social patterns, and shape flows of trust, attention, participation, and productivity. My exciting insight came in 2001 when I read Bernard Lietaer’s book, The Future of Money. It helped me see the ways our monetary system has shaped our culture and even our sense of humanity. That’s when I realized the things we had invented were in fact new kinds of currencies, and that currencies are the main tools we use to shape patterns in community and culture. They are the DNA of our social organisms.

Artificial scarcity fosters competition, pitting everyone against each other and impairing large-scale collaboration. Charging interest forces short-term financial thinking, so we perpetually mortgage our future for short-term gain. These behaviors are not human nature; rather, they are characteristics of our money system. But we can design currencies that yield very different patterns and relationships.

Current-Sees: Learning to “See” Value Together

A common blind spot we have about how social systems work is rooted in a failure to differentiate between the aggregate behavior of individuals and the coherent behavior of social organisms.

An advertising campaign to reduce water consumption is an example of change at the level of aggregate behavior. Each individual, acting alone, adjusts personal habits and behavior. A billboard campaign may make possible changes visible and provide easy ways to participate (e.g. turn off water while brushing teeth; put a brick in your toilet tank). Changing individual awareness may work in these cases. Although there is usually a large gap between awareness and behavior change.

We also mistakenly think the behavior of companies, governments and institutions is similarly the sum of the behavior of individuals in those organizations – but it isn’t. There is a fundamentally different pattern of coherence - a different intelligence. If a nature-loving CEO of an oil company sacrifices short-term profit for environmental benefit, the board will replace him. Even though the clerk behind every counter at the DMV obviously knows that you were born, they won’t issue a driver’s license without a birth certificate. Individual awareness in this context is almost irrelevant. What matters is the pattern of awareness wired into the social organism.

How is “awareness” wired into organizations? Through the currencies we create as shared symbol systems to shape, enable and measure value flows (Think “Current-Sees” to keep in mind they’re not just money.). These currencies form the nervous system of a social organism, and they are the best way to observe and to modify its pattern of awareness.

As humans, we know that people are born and that they die, but as far as the government is concerned, citizens are issued through birth certificates and expired through death certificates – and a government’s systems are designed to service citizens. A government service literally cannot “see” you if you don’t show up in the currencies by which the flow of services are managed.

When my company implemented ways to measure performance and integrated this into the payroll process, it meant that the collective social organism could suddenly “see” and respond to different flows of value the employees provided. This created new social patterns and hence a new culture and new pattern of awareness or intelligence in the company.

Discovering Deeper Wealth

Money and its accounting practices have led us to believe that the things we easily measure with dollars are “tangible” and things not so easily bought and sold are “intangible.” A deeper look casts doubt on this conclusion. Under general accounting practices, sources of all value are not actually valuable (like health, ingenuity, trusted relationships, well-functioning teams, the fertility of nature, etc.) only their saleable by-products have value (like drugs, patents, purchases, labor, products, crops, commodities, etc.). By what a currency measures and fails to measure it wires a particular pattern of awareness into our businesses, governments and institutions.

This pattern not only yields the unsustainable “kill the goose that lays the golden eggs” syndrome of over-working, over-fishing, over-harvesting, and over-leveraging everything, but leaves us with a deeper poverty than just a shortage of money. It means we have wired into our social systems a fundamental incapacity to see or nurture deeper value. We suffer from a poverty of measurement, obscuring a mountain of wealth behind a molehill of money.

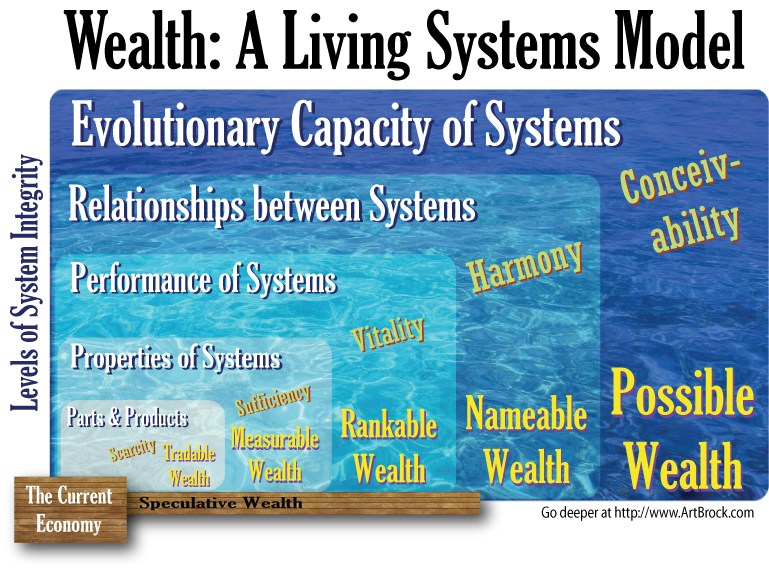

So what is the key to unlocking deeper dimensions of value? We can learn about it from living systems.

Every living system operates in multiple layers or dimensions. Each dimension embodies a different kind of wealth. And each of type of wealth is enabled by different kinds of currencies. A body, a community, an ecosystem, and the planet are all living systems.

Let’s look at how this works using a familiar example of the human body:

- Product: I can produce more blood than my body needs, so I could donate (or sell) blood as a product. That product is separable from me as a living system, so it is tradable.

- Property: The blood I donate is of a particular type, but my blood type is an inseparable property of me and can never actually be traded or exchanged. It can be measured and that is exactly the type of wealth that makes it possible for blood transfusion to have value instead of hurting people.

- Performance: We measure blood pressure as if it’s a static property taking a snapshot in time. But it changes each moment and is interpreted by comparing it to past measurements and those of other healthy people.

- Relationships: My overall cardiovascular health is indicated by various vital relationships such as: iron consumption and integration, blood oxygenation efficiency, red blood cell production, capillary function, exercise habits, etc…

- Evolutionary Capacity: Our ability to change ourselves at the other levels based on an understanding and representational model of the overall system function (example alterations: new parts via transplant, properties via transfusion, performance via pacemaker, relationships via training for a marathon)

- The Current Economy: I could sell my plasma and platelets for $75. It’s pretty clear that those dollars are completely decoupled from me as a living system. A price change does not alter my health nor does my body produce faster or slower because of it.

| Systemic Aspect | Level | Type of Wealth | Type of Measure | Currency |

| I donate 0.48 liters of blood | Product | Tradable (separable from my body) | Rational numbers / divisible parts | ml per kilogram |

| The blood is one of 8 blood types | Measure | Measurable (but inseparable) | Whole numbers, indivisible parts | blood types |

| Right now, my blood pressure is 117/62 | Performance in Real-Time | Rankable (compared to my past and to others) | Dynamic (changing every moment) | mm of mercury displacement |

| My overall cardio- vascular health is…. | Systemic Relationships | Nameable (relationships that can be acknowledged) | Nominal (named with words) | Named Relationships |

| My ability to change my cardiovascular health | Evolutionary Capacity | Possible (enhancements and new forms) | Generative / Grammatic (expressive capacities) | Models which represent system function |

| The current economy pays $75 for my plasma & platelets | (not part of the living system) | Speculative value (separate from body) | Fungible gambling tokens | Dollars |

I know that calling a corporation or institution a living system or social organism may seem strange at first, but if you look deeper, you can see:

- people operate as cells within a larger collective which has its own patterns of behavior (hard-wired awareness as discussed earlier),

- a self-preservation instinct,

- an ability to spawn offspring (spin-offs and subsidiaries),

- and a lifespan that extends beyond its individual cells.

Taking all those factors into account, it starts to become pretty clear that human organizations are, in fact, living systems.

Accessing Deep Wealth with Currencies

Now that we can see wealth is so much deeper than we normally think, let’s look at some quick examples of where currencies you know are already shaping social flows, but you may not have thought of them as currencies.

Education

A college degree is a reputation currency that reputes that a particular level of learning has been achieved in a specific field. Having this shared symbol system can make hiring easier by ensuring that we don’t have to train someone in the basic literacy of their specialty because a college already has.

You earn the degree by fulfilling the degree requirements (25 credits of this, 15 credits of that, 12 credits of this other thing, etc). The credits are unit of account currency used to measure the hours of coursework you have completed in an even more specific domain of study.

The credits only count if you got a good enough grade. Grades are a performance metric currency attempting to measure how well you learn the content of a course.

These three non-monetary currencies shape the flow of participation of students, they divvy up power within a university based on who gets to issue them (professors issue grades, departments issue credits, the college issues the degree), and they also shape flows of job hiring in the workplace.

Food Systems

Do you remember when food was just food? It wasn’t organic, non-GMO, cage-free, cruelty-free, hormone-free, free-range, grass fed, fair trade, locally-grown by independent farmers, and so on.

These are all reputation currencies that are making particular flows in the production process visible because we care about more parts of our living systems than just type and price. You may care about what chemicals you’re eating, how “engineered” the food is, how animals are treated, how people are treated, how much poison was used, or how far it travelled. But when you look at an apple, or a cut of meat, you can’t see those parts of the flow unless we create a symbol system that makes them visible.

Those currencies are changing the patterns of how food is produced, how animals and people are treated, how much buyers will pay, and where they go to shop. Many of the currencies are certified by third-parties to ensure the credibility of the claim.

Everywhere

Think about how the existence of Olympic Medals shapes the participation of millions of athletes all over the world… How product ratings and reviews change buying patterns as well as production patterns as businesses are more transparently held to account… How postage stamps make it possible for postmen to accept and deliver mail without having to accept and carry money…. How eBay feedback scores help guarantee responsible behavior in a semi-anonymous online marketplace… Or how sporting event tickets solve a complex flow problem of letting thousands of people into multiple doors and putting them into seats in an orderly manner.

We use currencies everywhere to solve problems and shape social flows, and mostly we haven’t even recognized them all as currencies. Imagine building something out of mud, and another thing out of stone, another from wood, another from brick, and thinking they’re all disconnected and different because different materials were used. Yet, if we recognize them all as buildings we can start to create a field (architecture) that works with some of the patterns that these things all have in common.

The Architecture of Currencies

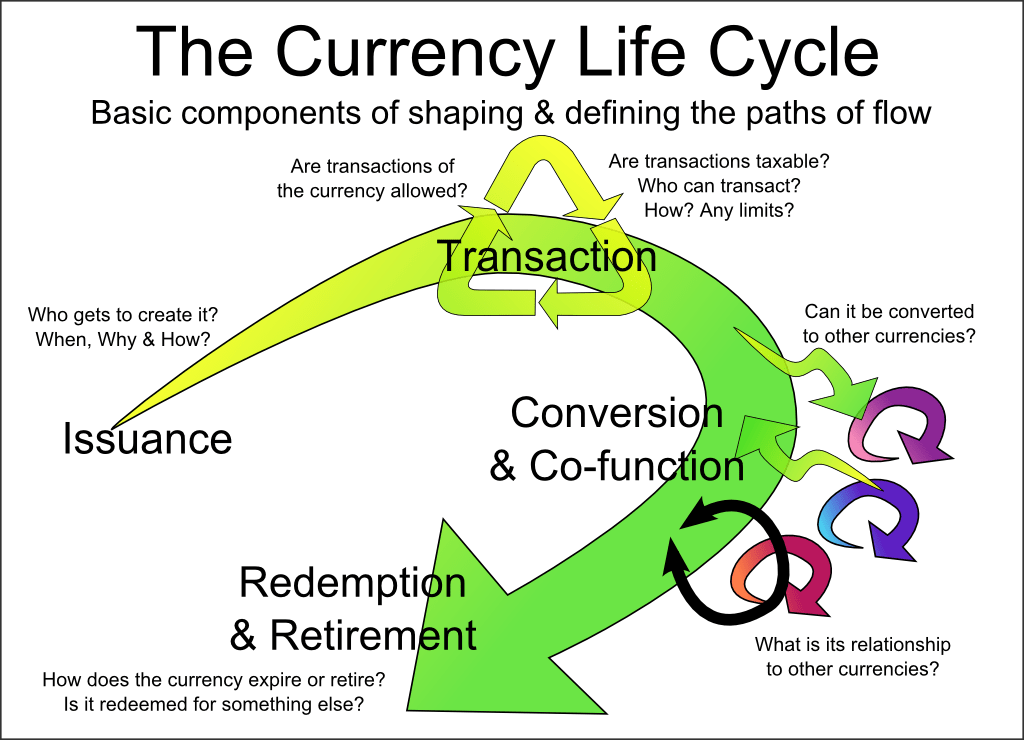

In a symbol system we call a currency, there is a particular life-cycle for the the tokens or symbols. You must define the rules for each stage of this cycle.

Tokens are issued or created according to a set of rules about who can create them under what circumstances. Tokens may be transacted by the people using the symbols. The tokens may inter-connect, convert or co-function with other currency systems. And the tokens may be redeemed, retired, or expired at some point.

Issuance

Often, the credibility of a currency depends on limiting who gets to create the tokens. Using the previous examples, you can’t give yourself a college degree. “Organic” is certified by the US Department of Agriculture. You can also use issuance to establish where or under what conditions a flow pattern originates. For example, you must complete a purchase to give feedback ratings on eBay.

Transaction

A good monetary currency should be optimized to make transaction easy, painless, and natural. But sometimes there may be limits and guardrails built in, like a currency targeted to supporting the local economy limiting membership to only local residents or locally owned businesses.

Design Tip: A good reputation currency should not allow tokens to be transacted (change owners), just as we should not be able to exchange our college degrees. This is a common error since money dominates most people’s imagination about currencies. Don’t let people buy reputation, nor should you diminish their reputation because they used the credibility it gave them. That kind of application calls for multiple currencies which function together.

Conversion & Co-function

For example, dollars (a monetary currency) operates in tandem with a credit rating (a reputation currency) which affects the cost and availability of money (by changing credit limits, interest rates, transaction fees, availability of loans, etc.).

Earlier, we explored how degrees, credits and grades function together to shape flows in education, but different levels of degrees also function together. A high school is needed to get into college. A college degree is needed for graduate school, and so on. You don’t redeem your degree to get in since it still remains yours and you could use it again to get into a different school.

Consider the interwoven currencies that shape the flow of baseball game: balls, strikes, fouls, outs, runs, walks, innings, and so on. Sometimes the connections are easy (4 balls is a walk, 3 strikes is an out) and sometimes they’re complicated (a foul ball counts as a strike unless it’s the third strike, a game has 9 innings unless the teams are tied).

Establishing good rules about how currencies convert and co-function lets you build rich constellations of flows which can feel much more diverse and organic than simple circuits.

Redemption & Retirement

Just as tokens have to start somewhere with issuance, they also have to end somewhere. They may expire, be redeemed, or be revoked. (Did you know your college degree could be revoked?)

Just as currency tokens come into being, they need to go out of existence. Postage stamps get cancelled. Frequent flier miles get redeemed or expire. It comes as a surprise to most people to learn that dollars actually retire from circulation when you repay principal on a bank loan.

Building Complete Circuits

Think about the “water cycle.” Water evaporates from the the ocean, falls on land as rain, flows back to the ocean. You need to ensure your currencies can and will complete similar cycles: For example, flow back and forth between individuals and businesses (as paychecks for employees, who spend back to local businesses for their products.)

Another simple flow cycle: The government issues food stamps to people who need food, then limits transactions to the purchase of grocery items, and allows grocers to redeem them for cash from the government again – cycle complete.

Success Strategies

Unfortunately, just creating a currency does not guarantee success in creating the social flows that you desire. There are a lot a poorly designed currencies. Many aren’t interesting or useful enough to gain much participation. Some even backfire producing very different and often conflicting results than what was intended.

These are some tips from almost two decades of experience designing and implementing these sorts of systems:

FORGET ABOUT MONEY: Push it out of your mind. It is probably occupying too much space in your imagination about what’s possible with currencies. Start by ruling out that option so that you can begin to see other approaches. The most certain failure is to create a money-clone that is less useful, less liquid, less popular, less easy, and less likely to be used. In the end, if you need a monetary currency in a rich offering of exciting currencies, then you can add it in later. It’s best to set the monetary approach aside so that you can see other dynamics for nourishing healthy social flows.

Target your audience and your niche: Don’t try to be everything to everyone. Figure out who your early adopters really are and serve them. Not everyone in a region or neighborhood is your customer. Figure out what matters most to the ones who are going to get on board. Or target such a specific group of people that their needs are clear.

Make your currency irresistible: Solve a pressing problem that they know they have. There should be no doubt about whether your currency is relevant. It’s okay if they don’t know yet if it will work, but there should be no question about your target users being completely on board for the intent.

If it ain’t broke, don’t fix it: Don’t use currencies where you already have healthy flows established. Adding new overhead and distraction risks messing up social flow patterns that are already working well.

Borrow good patterns from nature and living systems: We are surrounded by healthy living system patterns that optimize nourishment for the most players in the system. Whether cells in a body, or organisms in an ecosystem, there are powerful patterns of information, flow, sharing, interdependence, mutuality, and social connection. Don’t be too proud to learn from atoms, cells, plants and animals. They’ve figured out quite a few things that we still struggle with.

Cross the streams: If possible, put your currencies and interactions at the intersection of needs or problems. See Curitiba Trash Tokens for an elegant example of addressing trash, plague/health issues, transportation, employment, a small amount of “money” for the unbanked by intersecting specific needs with simple plastic tokens. Use your currency to uncover hidden value that’s already present or to activate idle and latent resources.

Make good easy: People will game your currency system. Make sure it’s designed to incent desirable behaviors when people try to game the system. Make doing the right thing, the easiest thing to do. Also, make sure that overall it’s as easy to use as possible without compromising critical features.

Establish community, credibility & trust: Figure out who the right players, backers, or anchor participants are that you need to get on board up front so that others can be confident in your currency.

One Final Illustration – with “Do’s and Don’ts”

The Alternative Currency working group at Occupy Wall Street discovered the work of MetaCurrency Project and decided to organize a “Reinventing Money Day” and invited us to speak. We sat down with some folks who really wanted to design an Occupy Currency. They wanted to create a way to reward or “pay” the people who were supporting Occupy with food, donations, time and energy. They imagined printing paper bills and even crowdsourced a design for the bill.

Don’t mess with a flow that’s already working by putting a currency in place that will introduce all sorts of new problems and confusion. Who gets to issue it? What can it be redeemed for? Who decides who gets paid? What is it worth? And so on… This confusion wasn’t necessarily going to be limited to Zuccotti Park, they wanted other Occupy groups to be able to download the currency to print to support their activities as well. Now, how do you keep everyone from downloading and counterfeiting?

Don’t create a general purpose currency to try to meet EVERY need. This is a case when trying to please everyone tends to please nobody. They weren’t solving a specific problem or meeting a specific need. They were just thinking about how money normally works. Since people were supporting them, they “should” pay those people something, right? Probably not if they’re paying in something which is not actually spendable and may also create resentment in those who haven’t gotten paid in the past.

Do solve a clear and relevant problem. We asked for a pressing problem they were currently experiencing. They told us about how the police were sending vagrants and people they released from jail down to OWS for free food, blankets, and camping supplies. Since OWS wanted to be open and inclusive, this meant a lot of people down there who were not necessarily respecting guidelines related to sobriety or quiet times for sleeping. Many of the activists now had difficulty sleeping through the night time noise and partying. But the topic was divisive and difficult to be clear if it was a widespread issue or only affecting particular places or people. Now this was a clear social flow problem we could work with!

Do provide an easy and elegant solution. We suggested that they introduce a simple coffee bean currency. Each morning in the breakfast line at the food table, as each person gets their food, ask them to indicate how well they slept by dropping a coffee bean in one of three jars with red/yellow/green lids. Each day there would be a clearly visible indicator of this particular aspect of well-being in the community for all to see. Now they can know when there’s a major issue, or when there’s scattered complaints. There’s no need for complicated vote-counting, data collection, analysis or surveys, because feedback is incorporated it into an existing process that adds 2 seconds, and you can eyeball the results. It yields an added bonus of everyone feeling like their voice and their well-being matters.

Conclusion

The eye-popping, jaw-dropping response we got when we described the coffee bean currency is a normal response to an out-of-the-box currency solution to intentional designing social flows.

For the last ten years, I’ve made my living by listening to people’s flow problems in their business, their local community, their local economy, their online community, their family, or their relationships, then providing surprising currency solutions in response. I just give these ideas away for free since nobody knows they need “currency solutions.” Luckily, when the pop-eyed, drop-jawed people say “Wow! That’s exactly what we need! How can we do that?” many times the answer is, “My software company can build that for you.”

The exciting thing is the transition from nobody knowing they need these kinds of solutions, to having a book like this one. People are discovering that they can intentionally shape these kinds of social patterns. As more people become “literate” in this kind of currency design, these kinds of elegant patterns become more pervasive.

These elegant patterns of social flows bring us closer and closer to a kind of social collective intelligence that we can currently barely imagine. I believe we will soon have tools which help us create a new kind of “Cambrian Explosion” of new social organisms which will outperform conventional business, economics and government models that we use today.

This vision is what fuels my passion for this work. Through this larger collective intelligence we can heal the disastrous imbalances which have resulted from our current cancerous patterns, and we can build new healthy social patterns which nourish each other and the planet.

Are you one of the next designers of social flows?

Practical Resources for Support

Exemplary Currency Systems for Designing for Social Flows

Currency Design

- Flowspace Brainstorming Worksheet from Metacurrency

- Decision tree / Currency map: What are the decisions you need to make in designing a currency?

- Dimensions of Incentives: How to use measures and currencies in ways that connect appropriately to people’s fundamental motivations.

- Community currency design framework: This is oriented toward monetary currencies but includes some good design resources

Arthur Brock

SOCIAL DNA · DESIGN PRINCIPLES · CURRENCY DESIGN · CURRENCIES · CULTURE · COLLECTIVE INTELLIGENCE